Travel the World with OCBC Cashflo Credit Card

October 24, 2016

With the approaching festive holidays in December, we’re pretty sure you can’t wait to drop all your work and just hop on the next plane to the destination you’ve been dreaming of. How does relaxing on a beach in Danang with a glass of Pina Colada sound? Or visit the northern most city in Japan?

In Danang, you get to bask in the sun with a good read in a stress-free environment and forget about all the worries in the world. In the evenings, couples would be attracted by the lovely private beach side dining concepts, especially if they’re as romantic as the one at Koh Samui.

At Wakkanai, the northernmost city in Japan, it is a compact town between the Sea of Japan and the Sea of Okhotsk. It is windy with many fishing boats bringing in rich catches of seafood such as crab, sea urchin and scallop. If the weather is clear, you can look over Rishiri Island, Rebun Island and the beautiful setting sun.

Or sit in the streets of Bangkok and enjoy a comforting bowl of claypot river prawn porridge – the latest trend in Thailand. It is served with a open pot of piping hot tom yam porridge and huge river prawns, cooked over charcoal fire.

Don’t all these thoughts entice you to pack your luggages immediately and catch the next plane out of Singapore?

Well, like all of you, our main concern is cashflow problems and having insufficient savings. As the holiday season draws closer, prices for flights and accommodation increases drastically but we have the best solution for you! By applying for the OCBC Cashflo Credit Card, you don’t have to worry about burning a big hole in your pocket!

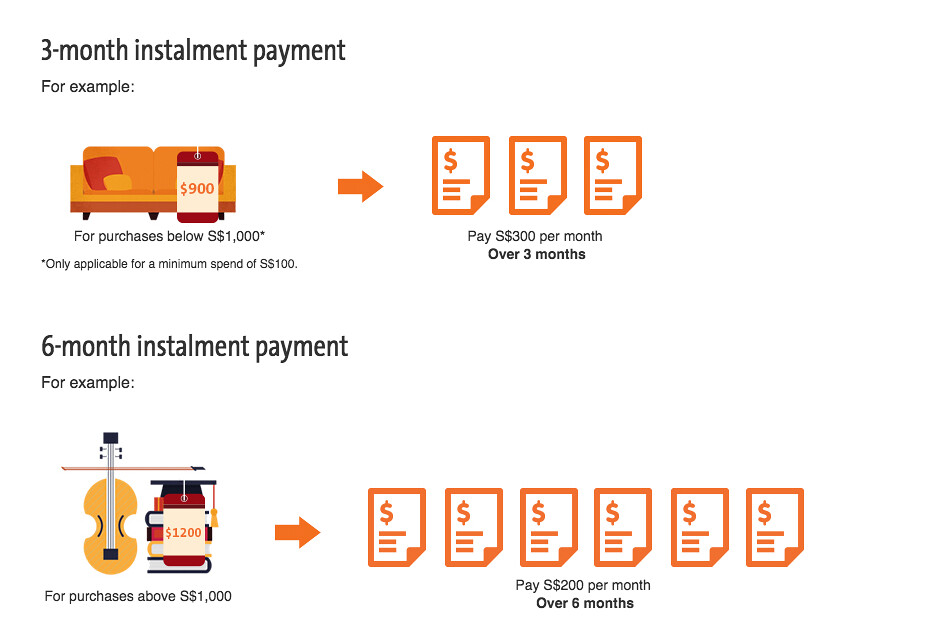

The Cashflo automatically splits your bill into 0% instalments and allows you to stretch your payments over 3 or 6 months. Pay over 3 months when you spend between $100 to $1,000 and pay over 6 months when you spend $1,000 and above.

For example, a plane ticket to and fro Perth, Australia might cost around $600. With OCBC Cashflo Credit Card, you don’t have to pay that lump sum of $600 at one go.

This card enables you to split your total bill into a 3-month instalment payment plan and you’ll end up paying $200 per month over 3 months.

For the 6-month instalment payment plan, let’s say you booked a hotel over 10 days for around $1,200. You’ll end up paying $200 per month over 6 months, and this ensures that you won’t be placed in a situation whereby you’re cash-strapped.

Furthermore, if you book your hotel stay via Hotels.com, you’ll get 8% off your hotel bookings using the promo code, ‘mastercard’ and paying with your OCBC Cahflo Credit Card. If you need travel insurance for your holidays, you’re able to get up to 50% off Explorer Travel Insurance with the OCBC Cashflo Credit Card.

You’ll also get cash rebates of up to 1% with any amount spent. There will be 0.5% cash rebate with monthly bill below $1,000 and 1% cash rebate with monthly bill of $1,000 and above. On top of these, you’ll also get movie discounts, dining privileges and more! Now, you can divide and conquer your expenses for more control over your finances!

Applicants have to be 21 years old and above, with an annual income of S$30,000 and above for Singaporeans and Singapore PRs and S$45,000 and above for foreigners. There is no annual fee for the first 2 years. Isn’t this a great deal? Online application for OCBC Cashflo Credit Card is very easy as it only takes 5 simple steps! Take this chance to travel more while still keeping your finances in check.

For more information, please visit https://www.ocbc.com/personal-banking/cards/cashflo-mastercard.html